In the realm of personal finance, the tax landscape plays a pivotal role in determining where individuals choose to reside and build their lives. One key factor that often influences these decisions is the presence or absence of state income taxes.

For those seeking to maximize their income and minimize tax burdens, states with no income tax become an attractive option. In this article, we’ll explore the U.S. states that levy no personal income tax and delve into the financial advantages they offer to residents.

Alaska

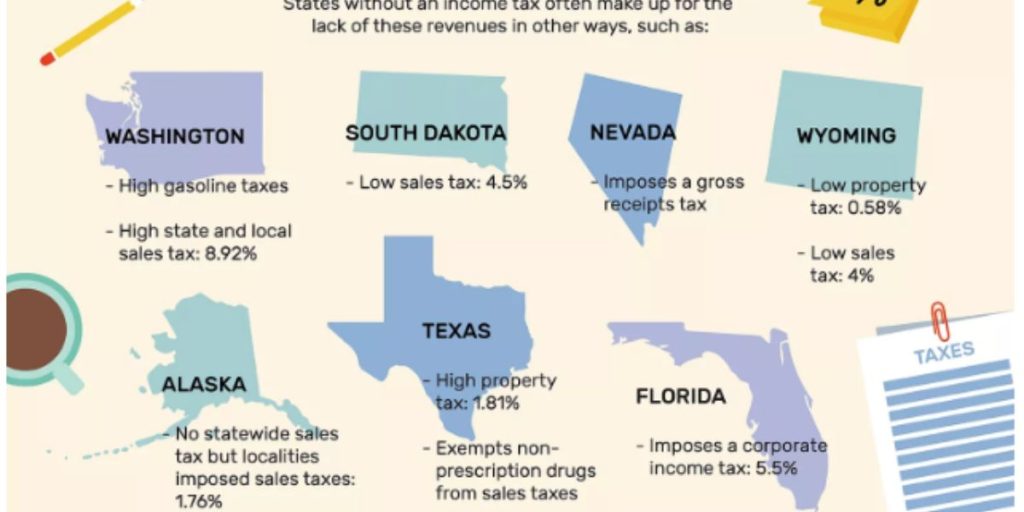

Alaska, the largest state in the nation, stands out as a fiscal haven for its residents. Known for its breathtaking landscapes and natural wonders, Alaska is unique in that it relies heavily on revenue from its vast oil reserves to fund state expenditures. The absence of a state income tax allows Alaskans to retain more of their earnings, contributing to the state’s appeal for those seeking financial freedom.

Florida

Sunshine and sandy beaches aren’t the only attractions in the Sunshine State—Florida is also renowned for its lack of state income tax. With a growing population and a diverse economy, Florida has become a magnet for individuals looking to escape the burden of income taxes while enjoying a tropical climate and vibrant communities.

Nevada

Nevada, famous for the glittering lights of Las Vegas and the expansive landscapes beyond, is another state that refrains from imposing a personal income tax. The Silver State’s economy benefits from tourism, gaming, and a business-friendly environment, making it an appealing choice for those seeking a tax-friendly residence.

South Dakota

Known for its wide-open spaces and natural beauty, South Dakota is an income tax-free haven for its residents. The state’s commitment to low taxes and a business-friendly environment extends to individuals, making it an attractive option for those looking to keep more of their hard-earned money.

Texas

The Lone Star State, with its vast landscapes, diverse cities, and robust economy, is a no-income-tax haven. Texas has long been a destination for those seeking economic opportunities, and the absence of state income tax adds to its allure, allowing residents to enjoy the benefits of a growing economy without sacrificing a portion of their income to the state.

Washington

The Evergreen State, known for its stunning natural landscapes and tech hubs like Seattle, is another state that does not impose a personal income tax. Washington relies on other revenue streams, including sales taxes, to fund state operations, offering residents a financial advantage and the opportunity to thrive in a dynamic economic environment.

Wyoming

The least populous state in the country, Wyoming, boasts more than just wide-open spaces and majestic mountains—it is also a state with no personal income tax. Residents of Wyoming enjoy a tax-friendly environment, making it an appealing destination for those who value financial flexibility and the beauty of the great outdoors.

Conclusion

The choice of where to live is a deeply personal decision, often influenced by a variety of factors. For those prioritizing financial considerations, states with no income tax stand out as attractive options. As individuals weigh the pros and cons of potential relocation, the absence of state income tax may tip the scales in favor of these tax-friendly states.